Setting Up Your Business Structure for a Cleaning Service

What business structure is best for a cleaning service?

Having a detailed business plan can assist you in determining the future direction of your future cleaning service and lay out an operational strategy. Once you have a strong business strategy in place, the next step is to put it into practice. Many details need to be done before your cleaning service is ready to begin. That includes deciding what business structure you are going to take. But how will you do it?

Taxes and risk exposures are also affected by the business structure of your cleaning service. If anything goes wrong, the whole structure might cause many problems and, worst, money. Planning your business structure before you acquire supplies and charge customers can save you time, energy, and money in the long term.

Don’t make a choice too quickly. Instead, digest as much as you can about every category into which your cleaning service may belong. Inquire about which business structure is most suited to your cleaning service business and which structure may help you achieve your personal goals and objectives.

Before doing the actual business, you must decide what kind of business structure your cleaning service will be. There is a lot of variables that will influence your choice. It includes whether or not you plan to work with a partner or how your new ventures will impact your personal interest. Depending on the legal business structure of your cleaning service, you may be subject to additional regulations at your local government, as well as your personal liabilities.

In the end, your selection will have a direct impact on your tax reporting and payment. It also tells you how much you pay in the long run. In terms of taxes and legal requirements, there are three primary types of business structures that you can have in Australia. Each offers benefits as well as downsides.

What are the three business structure types?

Sole Trader

It’s pretty self-explanatory. The term itself is a business structure run and controlled by a single individual. If your business incurs any debts or obligations, you will be held responsible for them. You’ll also keep control of your business assets. If you’re a sole trader, your business earnings are taxed together with your other sources of income.

As a sole trader, you are not subjected to any particular laws and restrictions, making it the most straightforward of the three business structure types to establish and manage your business. If you want your business to jumpstart with a bit of investment, then a sole trader is terrific. However, if you decide to use a different business structure, you may have to overcome more hurdles. Examples of sole traders are artists, freelancers, consultants, and other home-based business owners.

Cleaning business owner handling job management by himself

As such, if you engage in commercial operations without registering as a business entity, you have immediately been deemed a sole trader. Most cleaning service startups choose this type of structure simply because of its practicality and easy-to-operate structure (Bello, 2021).

Pros

- It is the quickest way to get your cleaning service business started.

- You don’t need to register or pay any taxes.

- Managing the business is flexible.

- Easy to operate.

Cons

- Starting solo can lead you to more risk exposures such as debts and legal obligations.

- Any obligation might be brought against you if a customer files a lawsuit.

- Raising capital is not easy, and no access to tax benefits.

- Personal assets might be at risk.

Pros and Cons of setting up cleaning business as a sole trader

Partnership

To manage a cleaning service business, you can handle it with two people instead of going solo. In a partnership, both parties have a defined job and own a portion of the business’s assets. They are also responsible for the business debts and obligations. In this kind of agreement, both creditors have access to each of their personal assets’ recognized partners if they pursue debts owing by the partnership.

Cleaning business owners working together with partnership as their business structure

There are both privileges and duties that come with being a partner. There are rules and regulations in place for partnerships. Your creditors may require a personal guarantee if you want to borrow money or have a line of credit. In addition, you’ll have to complete and submit an income tax form. The total amount of taxes you owe will be based on the total amount of money you make.

Pros

- Both partners share the ease and burden of the business, including earnings, losses, and financial liabilities.

- The management structure is flexible.

Cons

- When one of the partners exits, the business will end.

- Shared legal duties and liabilities.

- There is a risk of losing personal assets.

Pros and Cons of setting up your business structure for a cleaning service using partnership

Company

There has been a rapid shift toward establishing a business in this type of structure. A company might be considered a person in its own right because of its power by legislation. As a result, it has its own set of legal obligations and debts. In the same way that people are taxed and held legally accountable for their acts, a company may be taxed and must submit a tax return for the money it makes. Owners and stockholders are often shielded from the company’s responsibilities.

A memorandum and articles of associations must be adopted and filed by a company for it to be established. Here, the rights and duties of the company’s shareholders and officials are outlined. A corporate tax return is also required, and the company status provides legal protection of the company’s owners, who are not personally accountable for its obligations.

Business owners of a cleaning service set up as a company

It is easier for people to transfer or even sell their shares in a company, which is another benefit. For example, when the original owners retire, they can sell their shares in the company, thus transferring the business to a new owner.

Despite this, according to Crowdspring, companies are not permitted by law to sell shares to the general public, and they must still maintain internal documentation.

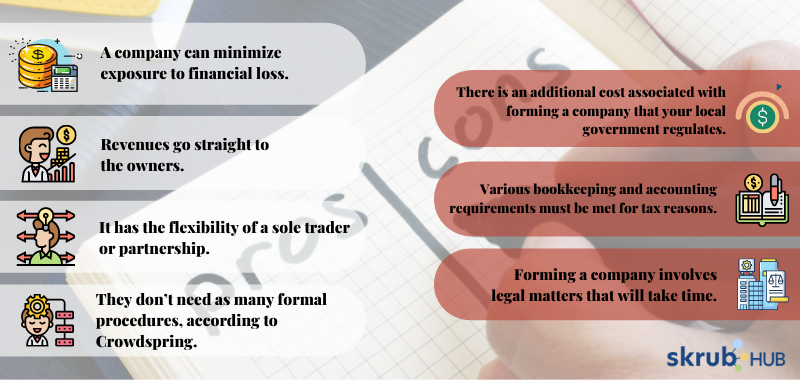

Pros

- A company can minimize exposure to financial loss.

- Revenues go straight to the owners.

- It has the flexibility of a sole trader or partnership.

- They don’t need as many formal procedures, according to Crowdspring.

Cons

- There is an additional cost associated with forming a company that your local government regulates.

- Various bookkeeping and accounting requirements must be met for tax reasons.

- Forming a company involves legal matters that will take time.

Pros and Cons of using Company as a business structure for a cleaning service

Factors To Determine Your Business Structure

When deciding how to form your company, there are several aspects to consider:

Cost Management

How will you administer the cost of your business? Can you manage it properly? Sole traders are the most straightforward kind of structure to start and run. Asie from maintaining records, there are no legal obligations included. In a partnership, an agreement should be worked out in advance. At the same time, legal documentation must be completed in a company before operating.

Demands

Where do you see your business in the next three or five years? What happens to a business if the owner dies? Suppose you ever decide to put your cleaning service up for sale. You can anticipate changes as it grows and develops, and such changes may impact your original business plan.

Legal Matters

Are you protected legally? Can you be held liable in the long run? It is vital that the structure you choose covers your assets and minimizes your risks and liabilities.

Flexible Management

Do you want to have complete authority over your business? Do you like to share responsibilities with someone? The number of owners in your cleaning business and the level of involvement will be critical in decision making and management.

Tax Concerns

Choosing one kind of business structure over another might result in significant financial savings. In addition, making the proper business decisions may help you save money in the long term by maximizing your tax advantages and lowering your tax rates.

Final Takeaway

Your choice of business structure for your cleaning service will be crucial to make when you start. The tax you pay and the quantity of paperwork you have to deal with will be determined by the business structure you pick. This will define how much personal responsibility you have in your new business venture regarding finances. Therefore, you should take the time to choose the best-suited business structure for you.

Learn as much as you can about the three categories into which your cleaning service can fall. Consider the advantages and disadvantages of each company structure before deciding which one is best for you when you establish a cleaning service. Think about the long-term viability of your cleaning service while deciding on a business structure.

Related Post

Attracting More Clients for your Cleaning Business Promoting your business has always been the most crucial part of your growth. It...

How to clean the driveway? Your home’s first impression always matters, as portrayed by the front of your house. Therefore, cleaning...

Types of Clients and Locations you’ll Encounter in your Cleaning Business Handling a cleaning is not always stable and repetitive...

What is a Good Profit Margin for a Cleaning Business – Tips for making your business profitable! For some people, cleaning...

How Much Should I Charge To Clean A House? Planning on the pricing of package rates and hourly rates for cleaning...

How to Clean and Store Equipment in Cleaning Offices Finishing procedures are also vital in the cleaning process. It shows...

How do you write a winning proposal for a cleaning contract? A cleaning contract proposal is a business document that...

Ultimate Methods To Market And Pitch A Cleaning Business The top ways to distinguish yourself from the rest of the...

How Do I Get a Cleaning Contract? You’ve already set up your cleaning business’s website, prepared all of the necessary...

What Do Customers Expect From a Cleaning Company Being new to the industry may feel like you are walking on eggshells....

Cleaning Business Tips on How to Keep Clients Happy When operating a cleaning business, customer loyalty is very important. A cleaning...

13 Simple Ways To Brand Your Cleaning Business Branding is more than simply an attraction and a catchy phrase. It talks...

6 Methods for Improving Cleaning Business Performance With today’s current technological innovation, enterprises and businesses globally evolve quickly daily. As a...

What business structure is best for a cleaning service? Having a detailed business plan can assist you in determining the future...

What equipment does a professional cleaner need? Here’s the answer… Have you considered establishing your own cleaning business? If yes, you...

Ultimate Tips for Organising Your Cleaning Company Having a cleaning business can be troublesome, and if you want to start one,...

Challenge: How Do I Start My Own Cleaning Business The concept of a cleaning business is very appealing, but before you...